The Truth About Partnerships Between Agencies and SaaS in 2024

*These are the facts we gathered from our ecosystem. You will learn how most tech and agencies prefer to partner, with what types of organizations, for what incentives, to what end result, and in what capacity.

Preface:

Before you dive in, here’s what to know about this data review:

The cohort we gathered this information from are SaaS and digital agencies who entered our ecosystem and filled out the onboarding details for Partnerhub® between 2020 and October 2024.

There is zero personal, private, or confidential information on our users in this report.

Because it’s directly out of Partnerhub®, this data focuses on companies either actively partnering, or interested in getting into new partnerships.

The data is from a part of user-onboarding inside Partnerhub®.

This data does not help us learn anything about companies who are uninterested in partnering.

Most of the text is directly from Alex Glenn, but we will be adding valuable quotes from thought leaders who have reviewed the data as we receive them.

The data is from the teams of over 3000 companies in Partnerhub® who answer:

- Detailed matching information much like a dating profile.

- Over 20 questions about how they partner.

- 100+ single or multi-select options to define them and how they partner.

- 8 on or off yes or no toggles.

Questions like:

- Which of these services does your solution make easier/better?

- Clients / users size?

- Who is your target customer?

- Which ecosystems do you work in?

- What region does this partnerships POC cover?

- Which of these agency types are best for your partner program?

- Do you Co-Market with Partners?

- If you map accounts and co-sell with Partners?

- Do you offer partners the ability to buy discounted licenses for resale to their customers?

Here’s how the analysis works:

Alex Glenn, CEO of Partnerhub® creates pivot tables comparing groups within the data.

Then, Alex provides his reasonings as to what the data is showing.

We also sent this report to others in the space asking for their comments on the data. You will see there’s as well.

Finally, we provide the data do our community and will be adding any of their insights as the report is read and replied to.

Section 1: The consensus from our team’s review of this data

This data gives us a unique perspective on partnerships in top SaaS ecosystems like HubSpot, Shopify, Salesforce, Microsoft, Snowflake…

We learn a ton from this data every year. And this year was no different.

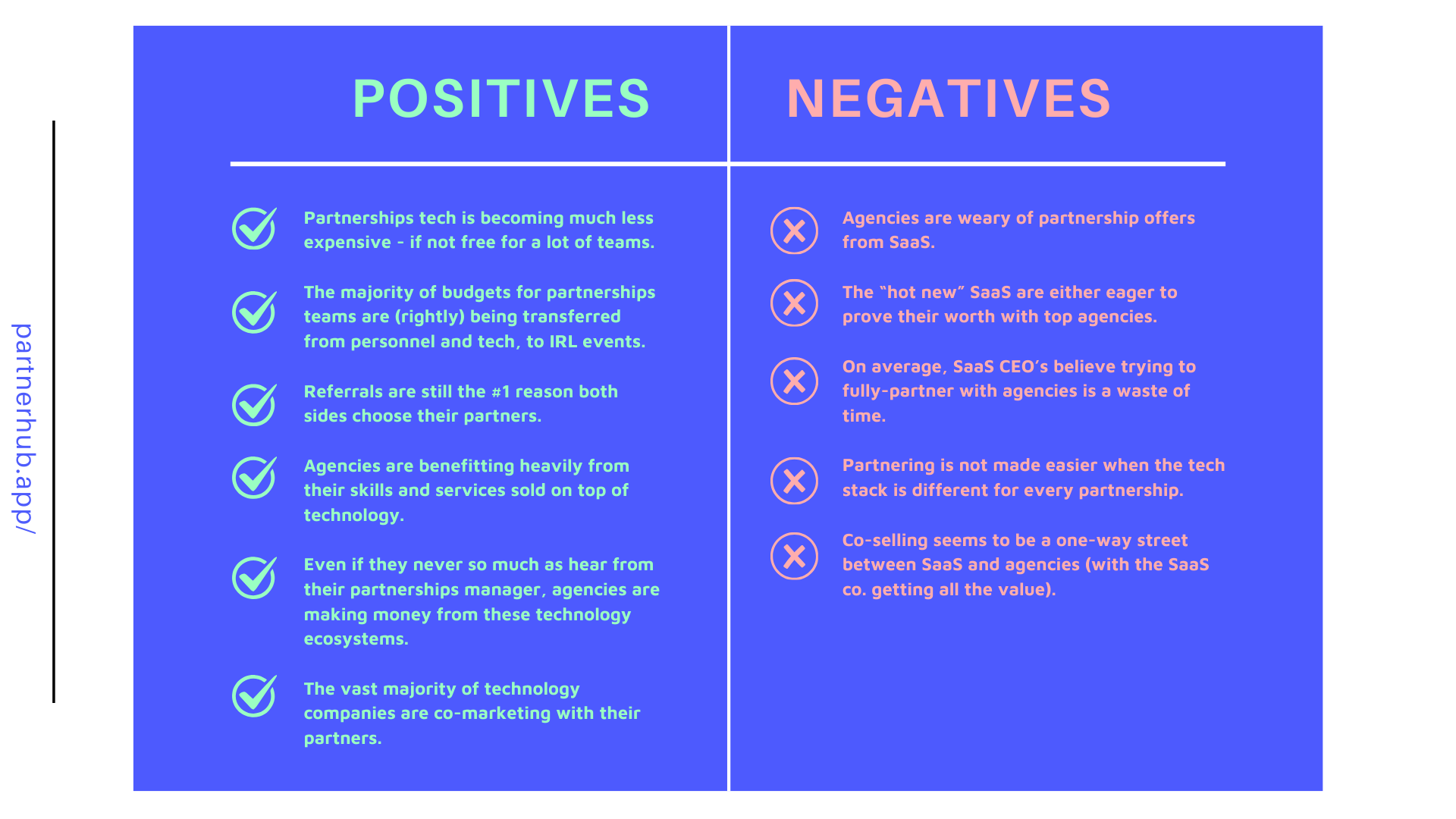

Some facts about partnerships today that we learned from this data:

|

|

|

|

|

|

|

|

|

|

|

While partnerships teams are being assembled and dismantled almost monthly, the largest issue preventing partnerships from being successful in any ecosystem more than ever is: reliability. Specifically, reliability on these fronts:

- A reliable product.

- Consistent processes.

- Setting and meeting expectations.

- And maturity - especially in terms of communication.

Both sides of the partnership need to rely on the other for these aspects. Then, you can pull on “partner incentive” levers like referrals and co-marketing to increase the activity within your partner program…

But, if you are changing partnerships point of contact every 6-months, not putting any processes in place, saying one thing and doing another, or not keeping partners in the loop… You will fail in partnerships.

Further, this data has given us some amazing insights in the partnerships within ecosystems - what makes them work, and what the companies inside are doing.

We are excited for you to read on and provide your feedback.

*If you’d like a relevant valuable quote added to this report, please email alex@partnerhub.app with the quote, your name, and backlink of choice. |

Section 2: Let’s talk specifically about agencies

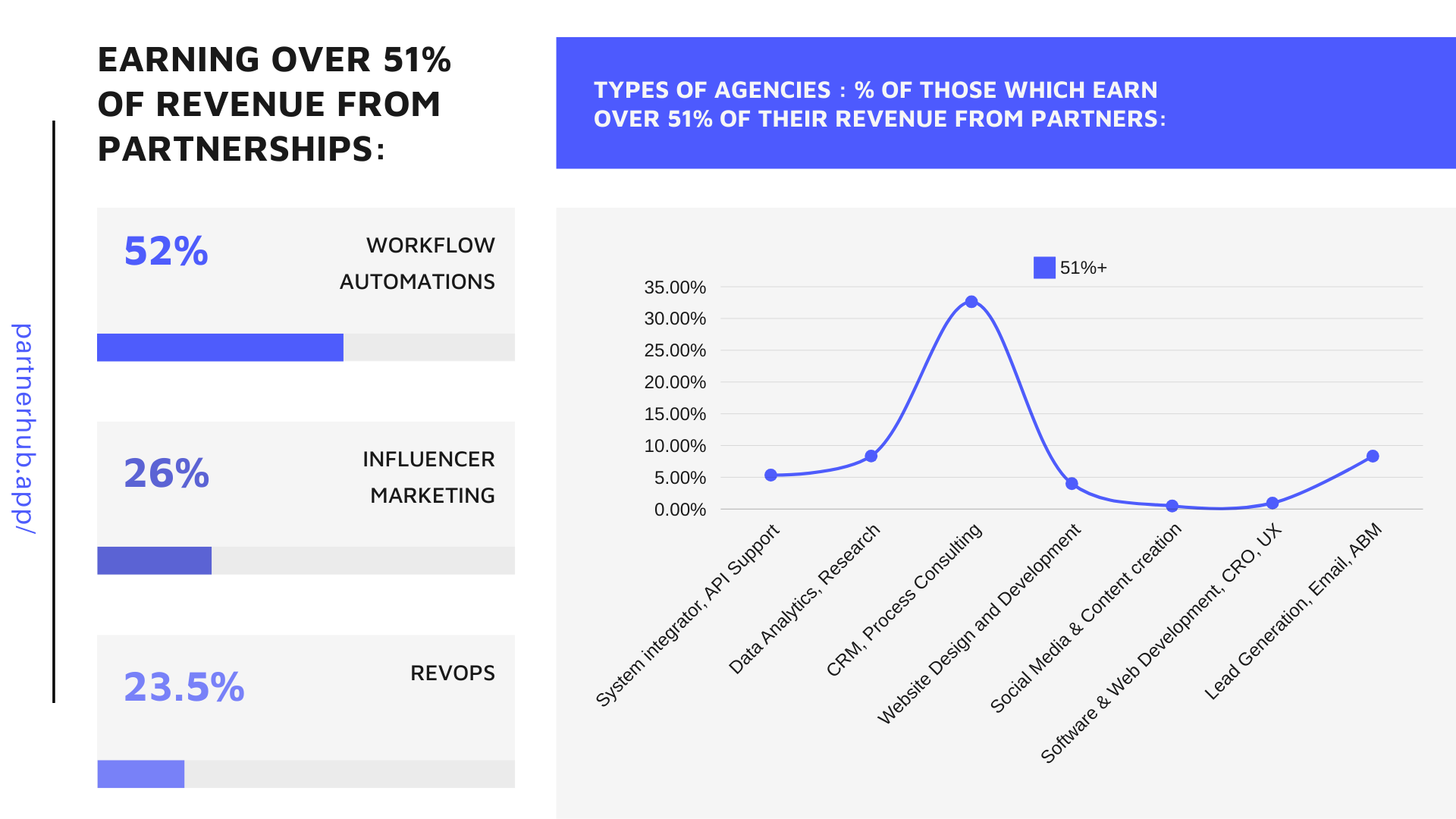

Here’s a breakdown of revenue from partnerships by agency service types.

I love this data because it shows us where partnerships truly play a role in the topline revenue of service providers.

In this first chart, we consolidated 26 different services into 7 groups, and we see now what “type” of digital agency can have the most potential for service revenue from partnerships.

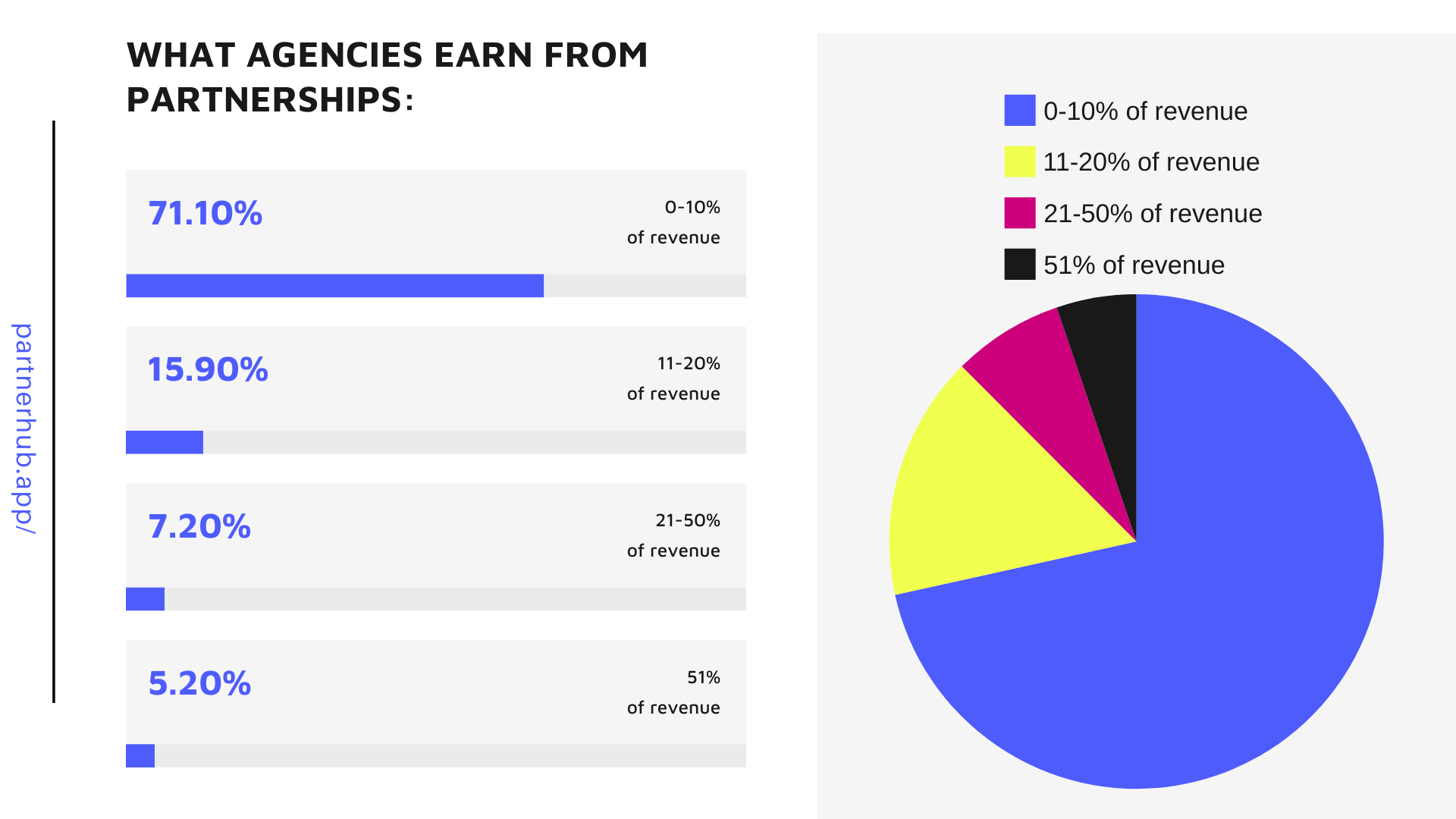

What agencies earn from partnerships:

% of agency-revenue from partnerships | % of agencies making this % of revenue |

0-10% of revenue | 71.10% |

11-20% of revenue | 15.90% |

21-50% of revenue | 7.20% |

51% of revenue | 5.20% |

What to know about this data:

- Although most agencies are earning less than 10% of revenue from partnerships, it’s surprising that almost ⅓ of agencies are making more than 11% of there overall revenue from partnerships.

- “The real question: if most agencies make less than 10% from partnerships, why do so many focus on lead gen from partners? Are the other 28% prioritizing partnership goals differently? My hypothesis is that those making the most from partnerships are doing so because they're focused on client outcomes and strategic engagements.” Chris DuBois, Dynamic Agency OS

Ecosystems which partners attribute over 50% of their revenue:

Ecosystems | Over 50% of their revenue from partnerships |

B2B (HubSpot, Salesforce, Pantheon, Webflow, ...) | 5.40% |

eCommerce (Shopify, BigCommerce, Klaviyo...) | 4.90% |

Software dev (Azure, AWS, Google...) | 4.70% |

What to know about this data:

- Although it doesn’t seem like a huge discrepancy, the .5% increase in total number of agencies reporting over 50% revenue earned through their partnerships is quite substantial.

- Only B2B ecosystems are above the mean of 5.2% partners reporting overall revenue over 50%.

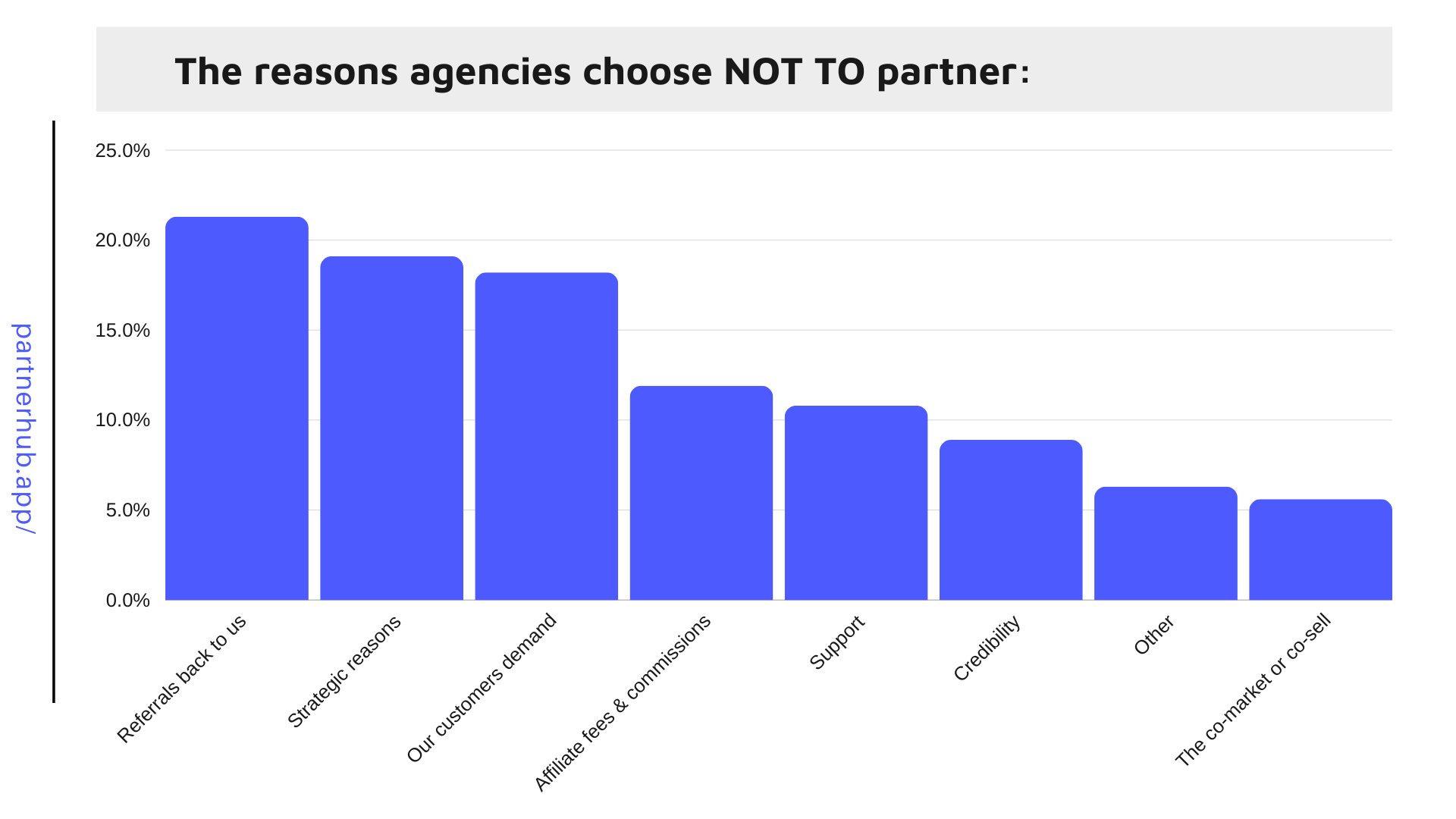

Reasons agencies choose NOT TO partnering:

Reason for NOT partnering | % of agencies who picked this reason |

I've never been asked or looked into any partner programs | 37.80% |

It's just a matter of time - we haven't looked into it yet | 18.90% |

Other | 12.60% |

Lack of referrals from partners | 7.20% |

The upfront costs of joining their program | 3.10% |

Referral fee's and other incentives are not worth the effort | 2.60% |

What to know about this data:

- The main takeaway from this chart is simply the top two results showing how few agencies are involved in a partnerships.

- This stat is not only shocking, but it goes to show you how bombarded with partnership offers the top percentage of agencies are getting while most agencies are never being asked…

- “This is a huge opportunity for smaller agencies to band together to create a comprehensive solution. Strategic partnerships can create a multiplier effect in efficiencies. ” - Chris DuBois, Dynamic Agency OS

- My assumption to explain why so many agencies are not getting approached for partnerships is that most partner teams are focused on the agencies listed in other SaaS partner directories.

- “Tech partners are probably not wanting to jeopardize engagements by sending things to untested partners. So the bigger, more proven agencies get more.” - Chris DuBois, Dynamic Agency OS

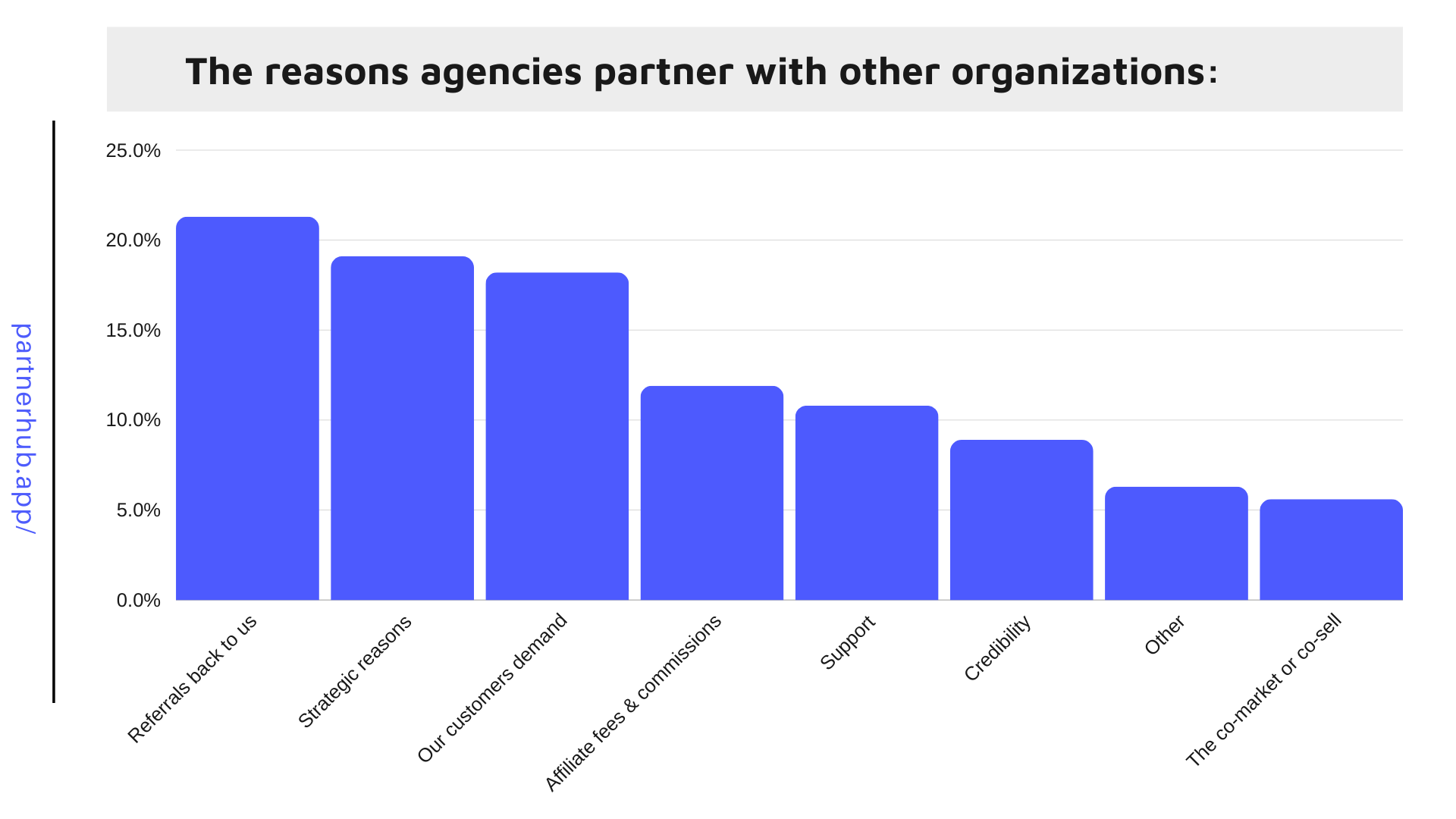

The reasons agencies ARE partnering:

Reasons our agencies choose their partnerships | % who picked this option |

Referrals back to us | 21.30% |

Strategic reasons | 19.10% |

Our customers use their product or service | 18.20% |

Affiliate fees & commissions | 11.90% |

Support from their team | 10.80% |

Credibility from being an expert brings us new business | 8.90% |

Other | 6.30% |

The co-market or co-sell | 5.60% |

What to know about this data:

- Referrals back to partners continue to be the #1 reason they seek out and stay in programs.

- This also shows why agencies tend to have 3-5 agency-referral partners for every 1 tech partnership - because agencies are much better at providing each other referrals than SaaS partners.

- I personally believe (Alex speaking) the reason the co-marketing and co-selling options are at the bottom is for two reasons:

- 1) Co-marketing is expected from partnerships at this point - so it’s not a driver of adoption or retention because everyone does it.

- 2) Co-selling is becoming a touchy subject for our agency partners in that it can be very one-sided (the tech partner getting all the value), non-existent (in that they have never done it), or a very positive experience for both partners (very rare in our experience for many reasons).

The top 3 reasons agencies choose to partner with other companies are:

| 21.30% |

| 19.10% |

| 18.20% |

The bottom three reasons agencies partner are:

6. Credibility from being an expert brings us new business | 8.90% |

7. Other | 6.30% |

8. The co-market or co-sell | 5.60% |

What to know about this data:

- Note; very few agency-partners are invited into co-marketing projects. And, we have heard some mixed feelings from agencies who are invited to co-sell with their saas partners (mostly negative, but some positive).

- ”Strategic” usually means they are partnering to help their agency move into a new market (i.e. an agency with partner with localization or compliance software who focus on EU countries when that agency is trying to win more business in the EU).

- The ”Other” option usually means they are just getting started and/or have a unique reason per partner.

Revenue from partnerships by service type sold:

Service type | Revenue from partnerships | |||

0-10% | 11-20% | 21-50% | 51%+ | |

System integrator, API Support | 68.65% | 13.43% | 11.58% | 5.35% |

Data Analytics, Research | 66.65% | 8.35% | 16.65% | 8.35% |

Revops, CRM, Process Consulting | 53.18% | 10.43% | 3.80% | 32.63% |

Website Design and Development | 71.80% | 17.70% | 6.50% | 4.00% |

Social Media, Influencer Marketing, Content | 86.27% | 11.53% | 1.71% | 0.48% |

Software & Website Development, CRO, UX | 92.42% | 3.99% | 2.65% | 0.94% |

Lead Generation, Email, ABM | 76.95% | 3.48% | 10.83% | 8.33% |

What to know about this data:

- I am consistently surprised at how few dev agencies get anything from their partnerships. With all the potential for website template libraries, customer success referral loops, and devops support intros… Not to mention the ability for a dev agency to gain referrals from other agencies… You would think dev agencies would rely on and make the most money from partnerships. But, ours don’t.

- The caveat to this is “app” or “software” dev shops who do seem to (according to the data below) be the outliers amongst the “development” shops in that 15% of them are making over 50% of their revenue from partnerships - presumably ecosystems like AWS, Google, Snowflake, Azure…

- HubSpot partners, who were the majority of the “Revops, CRM, Process Consulting” service category, are MOST likely to make the most amount of revenue from their partnerships. This comes at no surprise.

- “Really shows the value in the ecosystem you select. Based on what services you provide, you should choose accordingly.” - Chris DuBois, Dynamic Agency OS

- Social media and content marketing agencies are the least likely to have the support of partnerships. This also makes complete sense - Facebook isn’t helping their agencies win new deals. TikTok is trying to… But There are just far too many social media and content creation agencies for partners to help significantly.

Now, here is the data from the 26 service options we give our users when they create their profile in Partnerhub®.

If you are after niche agencies, or are one, this is a good place to pay attention to revenue expectations:

Core service | Revenue from partnerships | |||

0-10% | 11-20% | 21-50% | 51%+ | |

ABM | 75.00% | 0.00% | 25.00% | 0.00% |

API Integration Support | 33.30% | 16.70% | 33.30% | 12.70% |

App or Software Development | 70.00% | 7.50% | 7.50% | 15.00% |

Business Process Consulting | 66.70% | 15.20% | 15.20% | 3.00% |

Content Marketing | 86.20% | 10.30% | 3.40% | 0.00% |

Copywriting | 66.70% | 0.00% | 33.30% | 0.00% |

CRM Setup & Integration | 41.30% | 37.00% | 13.00% | 8.70% |

CRO | 83.30% | 0.00% | 16.70% | 0.00% |

Data Analytics | 33.30% | 16.70% | 33.30% | 16.70% |

Email Marketing | 78.60% | 3.60% | 3.60% | 13.30% |

Graphic Design | 95.00% | 5.00% | 0.00% | 0.00% |

Influencer Marketing | 74.00% | 0.00% | 0.00% | 26.00% |

Lead Generation | 75.60% | 6.70% | 11.10% | 6.70% |

Media planning & buying | 70.85% | 20.80% | 0.00% | 8.35% |

Operations | 100.00% | 0.00% | 0.00% | 0.00% |

PPC | 75.00% | 13.90% | 8.30% | 2.80% |

PR | 71.40% | 28.60% | 0.00% | 0.00% |

Research | 100.00% | 0.00% | 0.00% | 0.00% |

Revops | 50.00% | 26.50% | 0.00% | 23.50% |

SEO or SEM | 72.80% | 23.30% | 2.90% | 1.00% |

Social Media Management or SMM | 72.70% | 22.70% | 4.50% | 0.00% |

Software Development | 72.70% | 18.20% | 9.10% | 0.00% |

UX Design | 100.00% | 0.00% | 0.00% | 0.00% |

Videography | 100.00% | 0.00% | 0.00% | 0.00% |

Website Design and Development | 71.80% | 17.70% | 6.50% | 4.00% |

Workflow automations | 48.00% | 0.00% | 0.00% | 52.00% |

What to know about this data:

- Surprisingly, most workflow automation experts make a significant amount of their revenue from partnerships. These are the Zapier / Airtable / Make partners in general. Those ecosystems seem to be bearing the most fruit for experts.

- Services like research, graphic design, content marketing, UX, videography, operations… are the least supported by partners.

- “App” or “software” dev shops seem to be the outliers amongst the “development” shops in that 15% of them are making over 50% of their revenue from partnerships - presumably ecosystems like AWS, Google, Snowflake, Azure…

- Regrettably - we kept app dev and software dev in the same category instead of separating them into two separate options. Had we done that, I expect pure software development shops, who don’t focus mobile app development, to be making most of their revenue on top of partnerships overall.

*If you do find value in this growing annual grreport, please contribute to it by creating your Partnerhub® profile today. |

Section 3: Let’s talk about technology ecosystems.

As in, the software companies that support a ton of partners like AWS, HubSpot, Shopify, Wordpress, Google, Facebook…

These are the Wallstreets of partnerships. And if you want to grow quickly, you have to be selling well in one of them.

Here are the numbers for how much revenue each ecosystem is bringing to their partners:

Ecosystem | Over 51% of revenue from partnerships | Under 10% of revenue from partnerships | Between 11-50% of revenue from partnerships |

Microsoft / Azure partners | 8.20% | 50.80% | 41.00% |

HubSpot partners | 5.50% | 65.70% | 28.80% |

B2B SaaS (HubSpot, Salesforce, Webflow, ...) | 5.40% | 70.20% | 24.40% |

eCommerce stores (Shopify, BigCommerce, Klaviyo...) | 4.90% | 71.30% | 23.80% |

Software dev (Azure, AWS, Google...) | 4.70% | 63.90% | 31.40% |

Social media marketing (Meta, Insta, TikTok) | 4.70% | 72.40% | 22.90% |

Salesforce partners | 4.60% | 72.30% | 23.10% |

Web development (Wordpress, Webflow...) | 4.40% | 74.10% | 21.50% |

Shopify partners | 2.50% | 75.50% | 22.00% |

What to know about this data:

- With 8.20% of Microsoft agency-partners making over 51% of their revenue from partnership, and only 50.8% making less than 10% of revenue from partnerships… It appears, according to this cohort of Partnerhub® user-data, that Microsoft’s ecosystem seems to be support their partners better than the others we reviewed.

- It’s always been well-known that Microsoft has built a partner-first ecosystem that creates wealth for thousands. So seeing how well their partners are doing due to the partnership is no surprise.

- Conversely, With over 75% of agencies making less than 10% of revenue from partnerships, and only 2.5% of agencies making over 50% of their revenue from partnerships, Shopify partners seem to be attributing the least amount of value from their partnership with Shopify.

- This does not mean that these agencies do not make a lot of their revenue from their knowledge and expertise of Shopify development or marketing, it simply means the partnership with Shopify is not the reason they are working in the ecosystem.

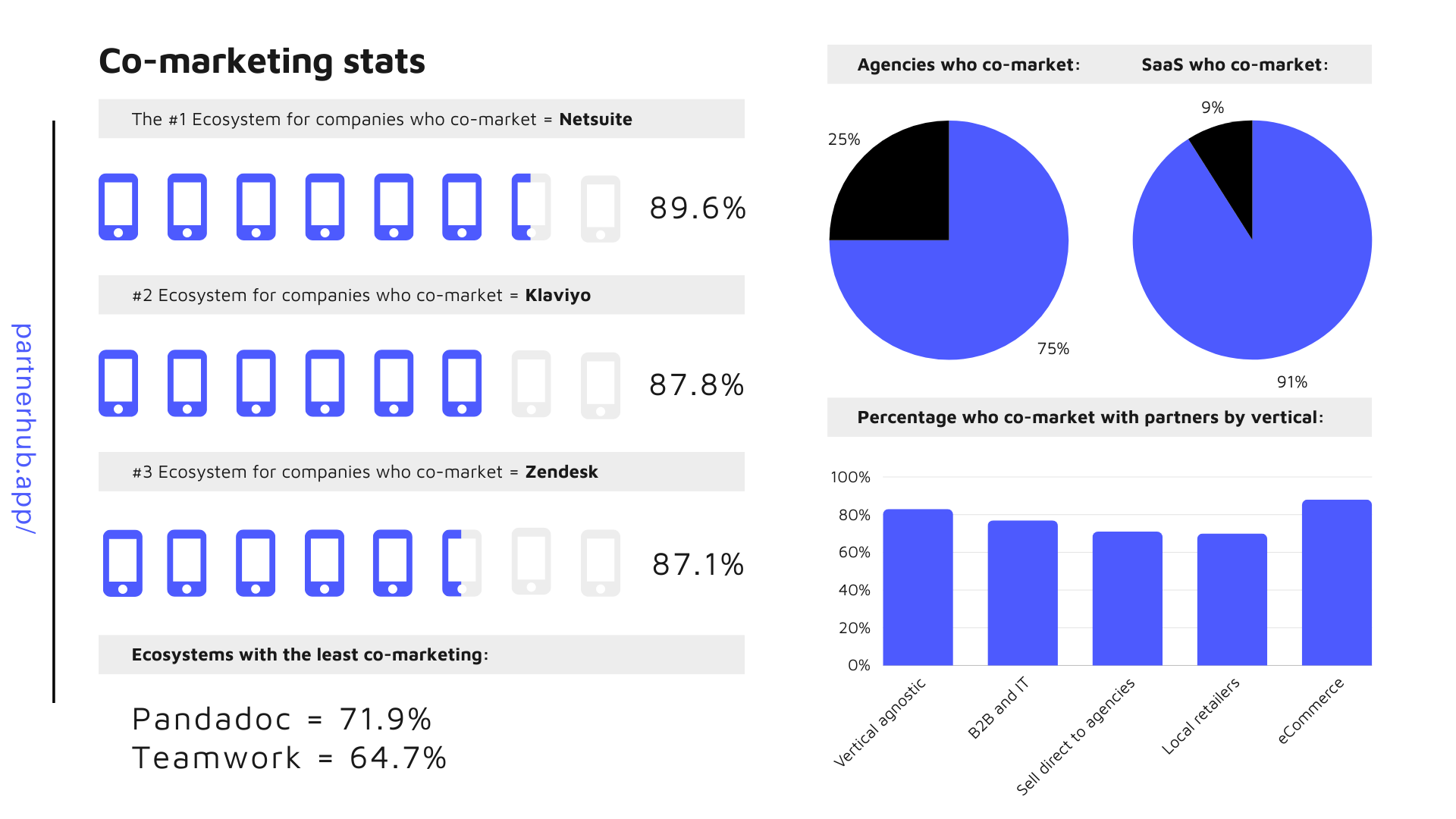

Section 4: Stats related to co-marketing

Co-marketing is one of the first and easiest ways to get started working with another company for mutual gain. If you are not looking for ways to get in front of your partners’ customers by way of their blog, newsletter, and social channels, you are leaving a lot on the table.

The most savvy partner leaders will work with thought leaders within partner organizations on marketing consistently. And, the savviest of the savvy know they do not need to try and “activate” those thought leaders by asking them for direct referrals. All they need to do is get brand mentions from those thought leaders on social channels, webinars, podcasts… and the buyers will enter the pipeline.

The “co” in co-marketing is also very important.

The ways you can be a great partner in a co-marketing strategy is to practice these principles:

Make sure you can reciprocate before you ask for any bandwidth from their marketing team.

You may not have as large an audience as they do, but you may be willing to do all of the work, or spend money promoting the content.

Do your research on what their company objectives are right now.

Have your agenda aligned with their marketing KPI’s.

Be ready with specific list of enriched targets that are a part of a shared ICP you plan to promote the content to.

Don’t just create one piece of content. Develop a multi-medium campaign. I.e. A podcast promoting a webinar > which becomes an article.

The good news is, we couldn’t find a technology ecosystem with less than 64% of partners co-marketing with one another.

Our data on co-marketing:

Ecosystem | % who co-market |

Netsuite | 89.60% |

Klaviyo | 87.80% |

Zendesk | 87.10% |

Pantheon | 86.60% |

Marketo | 86.00% |

Freshdesk | 85.90% |

Monday | 85.00% |

Amplitude | 84.90% |

Vidyard | 84.60% |

BigCommerce | 84.30% |

Salesforce | 84.10% |

Magento | 84.00% |

Webflow | 83.90% |

Zapier | 83.40% |

ActiveCampaign | 83.20% |

Shopify | 82.80% |

Make / Integromat | 82.00% |

HubSpot | 79.60% |

Wordpress | 79.20% |

Mailchimp | 78.90% |

Chat GPT | 78.80% |

OpenAi | 78.80% |

Xero | 78.80% |

78.70% | |

Atlassian / Jira | 78.10% |

78.00% | |

ClickUp | 77.90% |

Airtable | 77.80% |

Asana | 77.30% |

Pipedrive | 76.70% |

Quickbooks | 76.50% |

Adobe | 76.00% |

Facebook / Meta | 75.90% |

AWS | 74.30% |

Azure | 74.00% |

Amazon | 73.90% |

TikTok | 73.60% |

SEMrush | 73.60% |

Microsoft | 73.30% |

Snowflake | 73.30% |

Pandadoc | 71.90% |

Teamwork | 64.70% |

Company size by likelihood they co-market:

Company size: | Whether they co-market: |

1 employee | 100% |

2-10 employees | 97% |

11-20 employees | 30% |

21-50 employees | 97% |

51-200 employees | 29% |

201-500 employees | 98% |

501-1000 employees | 89% |

1,001-5,000 employees | 75% |

5,001+ employees | 100% |

Vertical by likelihood they co-market:

The vertical they target: | They Co-Market |

eCommerce and consumer brands | 88% |

Vertical agnostic | 83% |

B2B and IT | 77% |

We sell direct to agencies only | 71% |

Local retailers or professional services | 70% |

Verticals by likelihood they co-market:

Vertical(s): | Co-marketing | |

No | Yes | |

B2B and IT | 23% | 77% |

Vertical agnostic | 17% | 83% |

We sell direct to agencies only | 29% | 71% |

Local retailers or professional services | 30% | 70% |

eCommerce and consumer brands | 12% | 88% |

Type of organization by likelihood they co-market:

Type: | If they co-market: | |

No | Yes | |

Agency | 25% | 75% |

Tech | 9% | 91% |

Alt. incentives by % who offer them:

Alternative incentives to partners: | % who offer this: |

If they purchase lunch for partners during lunch & learns | 60.20% |

Provide a backlink to partners | 89.70% |

Offer discount licenses to partners | 61.40% |

What we learned about this data:

Of the top 30+ ecosystems we allow our users tag their profile as selling into, here are the to 3 of those wherein the MOST co-marketing happens between partners:

- Netsuite = 89.6%

- Klaviyo = 87.8%

- Drift = 87.7%

And the 3 ecosystems with the LEAST amount of co-marketing happening:

- Snowflake = 73.3%

- Pandadoc = 71.9%

- Teamwork = 64.7%

BigCommerce, interestingly, has a more co-marketing-friendly ecosystem than Shopify. At 84.3% co-marketing, BigCommerce’s ecosystem edges out Shopify’s in terns of intent to market with partners. Shopify came in at 82.8% co-marketing. Nothing to be ashamed of, but that 2% will help BigCommerce remain in the conversation.

- Companies in our network between 11-20 employees, and 51-200 employees were the least likely to co-market with their partners (only 30% and 29% respectively co-market with their partners), while the smallest companies (under 10 employees) and largest (over 1000 employees) are all co-marketing (Almost 100% likely to co-market with partners).

*If you do find value in this growing annual grreport, please contribute to it by creating your Partnerhub® profile today. |

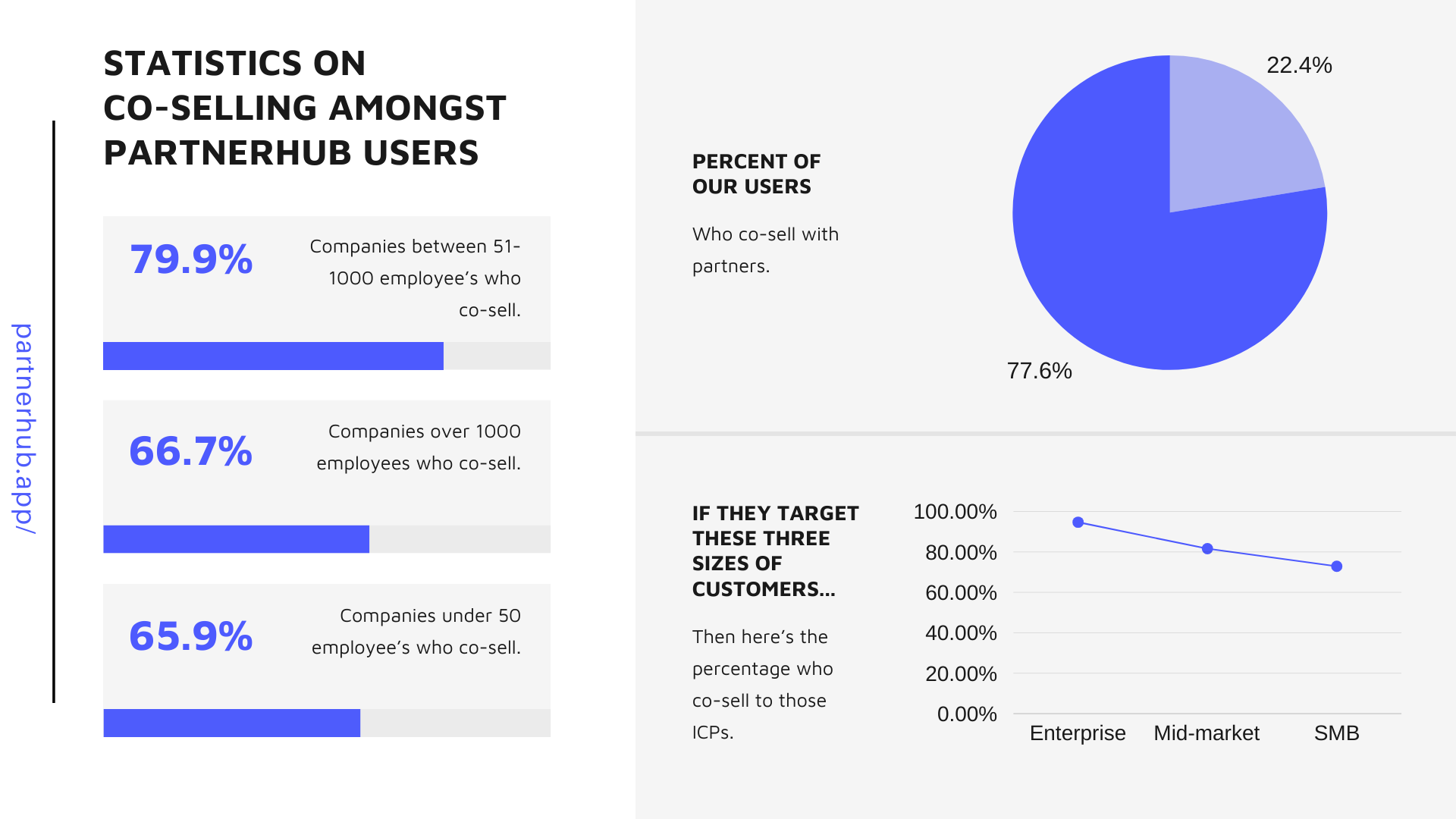

Section 5: Stats related to co-selling

And, here’s what we learned about co-selling amongst our users…

Interesting stat on #coselling from the Partnerhub® network: 77.6% - Of Partnerhub® users co-sell with their partners.

Here's the percentage of companies by their size who co-sell:

- 79.9% - Companies between 51-1000 employees co-sell.

- 66.7% - Companies with over 1000 employees co-sell.

- 65.9% - Companies under 50 employees co-sell.

This is surprising given how difficult co-selling is. Further, the bottom chart indicates that companies targeting Enterprise customers are almost all co-selling regularly.

Here’s the breakdown of companies likelihood to co-sell by size of customers they target:

Co-selling by size of their customers:

Customer size | % of these companies co-selling |

Enterprise | 94.70% |

Mid-market | 81.60% |

SMB | 72.90% |

Co-selling by vertical:

Vertical | % of these companies co-selling |

eCommerce | 80.40% |

B2B | 74.40% |

Local businesses and Professional services | 78.20% |

Co-selling by company size:

Company size | % of these companies co-selling |

<10 employees | 56.50% |

11-50 employees | 75.30% |

51-200 employees | 78.50% |

201-1000 employees | 81.30% |

1,001+ employees | 66.70% |

1,001+ employees | 66.70% |

Co-selling by the ecosystem:

Ecosystem name | % of their partners who co-sell |

Netsuite | 89.60% |

Klaviyo | 87.80% |

Zendesk | 87.10% |

Pantheon | 86.60% |

Marketo | 86.00% |

Freshdesk | 85.90% |

Monday | 85.00% |

Amplitude | 84.90% |

Vidyard | 84.60% |

BigCommerce | 84.30% |

Salesforce | 84.10% |

Magento | 84.00% |

Webflow | 83.90% |

Zapier | 83.40% |

ActiveCampaign | 83.20% |

Shopify | 82.80% |

Make / Integromat | 82.00% |

HubSpot | 79.60% |

Wordpress | 79.20% |

Mailchimp | 78.90% |

Chat GPT / OpenAi | 78.80% |

Xero | 78.80% |

78.70% | |

Atlassian / Jira | 78.10% |

78.00% | |

ClickUp | 77.90% |

Airtable | 77.80% |

Asana | 77.30% |

Pipedrive | 76.70% |

Quickbooks | 76.50% |

Adobe | 76.00% |

Facebook / Meta | 75.90% |

AWS | 74.30% |

Azure | 74.00% |

Amazon | 73.90% |

TikTok | 73.60% |

SEMrush | 73.60% |

Microsoft | 73.30% |

What to know about this data:

- The data shows us that the most prolific co-sellers, on average, are enterprise ecommerce-focused companies between 201-1000 employees in Netsuite, Klaviyo and Zendesk ecosystems.

- The least-likely to co-sell are SMB-focused B2B organizations under 10 employees selling into Microsoft, TikTok, SEMrush or Amazon ecosystems.

- That all being said, there are opportunities throughout this data to begin co-selling relationships with organizations on their way to being great co-selling partners. I.e:

- 51-200 employee companies in ecosystems like HubSpot, Magento, OpenAi, Xero, Google… who are selling to industries like medical, manufacturing, Real Estate, Auto, Furniture…

*If you do find value in this growing annual grreport, please contribute to it by creating your Partnerhub® profile today. |

Section 6: General facts about all of our users:

- 85.2% of our agencies actively partner with SaaS companies.

- The #1 TOP reason our Enterprise-focused agencies choose TO partner is "for referrals".

- The most common ecosystems our users work in are: Google, HubSpot, LinkedIn, Shopify, and Amazon/AWS.

- Most of our larger agencies focus on eCommerce and consumer brands.

Some general statistics about agency-partnerships:

- Of all ecosystems; B2B, eCommerce, development or not… only about 5% of agencies see over 51% of their revenue is sourced from partnerships.

- Percentage of Shopify agencies who earn LESS THAN 10% of their revenue from partnerships: 75.5%

- Percentage of agencies who DO NOT sell retainers AND make LESS THAN 10% of their revenue from partnerships: 69.7.

- Agencies selling into the HubSpot ecosystem making LESS THAN 10% of their revenue from partnerships: 65.7%.

- “Service saturation. Once an ecosystem reaches a certain size, there are diminishing returns for partners because there aren't enough leads to go around. There should be a name for that. The Starving Sibling Effect or something…” - Chris DuBois, Dynamic Agency OS

- The percentage of Enterprise-focused agencies who either have not been asked or are simply not partnering out of choice: 52.8%.

- Sell to mid-market+ customers AND earn UNDER 10% of their revenue from partnerships: 48.7%

- Percentage of HubSpot agencies making MORE THAN 10% of their revenue from partnerships: 33.9%

- "HubSpot’s growth speaks volumes about how much they value their partners. As a HubSpot website agency, Betta Webs depends on their platform to deliver tailored websites that drive real results for service-based businesses. HubSpot’s commitment to its partner network has been key to our success, letting us scale up our services and build real value for clients while helping HubSpot grow at the same time." - Rob Harris, Managing Director of Betta Webs

- Sell retainers AND earn UNDER 10% of their revenue from partnerships: 28.6%

- Agencies who sell retainers AND earn OVER 10% of their revenues from partnerships: 28.6%

- Sell retainers AND earn OVER 10% of their revenue from partnerships: 24.4%/

- Agencies selling into the Shopify ecosystem who earn OVER 10% of their revenue from partners: 24.1%

- Sell to mid-market+ customers AND earn OVER 10% of their revenue from partnerships: 19.3%

- Sell to SMB customers AND earn UNDER 10% of their revenue from partnerships: 9.0%

- Sell to SMB customers AND earn OVER 10% of their revenue from partnerships: 3.6%

General user-data percentages:

- 45% of our users are selling into the Shopify ecosystem.

- 74.9% of our HubSpot agencies say they co-market with partners.

- 74.7% of our Shopify agencies say they co-market with partners.

- 25.8% of our HubSpot agencies DO NOT do custom Web OR Software Development.

- 16.3% of our Shopify agencies DO NOT do custom Web OR Software Development.

- 14.6% of our users sell into BOTH Shopify AND HubSpot ecosystems.

- 9.9% of our Shopify agencies sell Web OR Software Development.

- 9.5% of our HubSpot agencies sell Web OR Software Development.

- 6.4% of our users sell into both Magento & Salesforce ecosystems.

- 1.7% of our agencies currently selling into AWS, Azure, OR Google DO NOT Software or Web Dev.

- 47.58% of Enterprise-focused companies said they DO NOT co-market with partners.

- 52.42% of Enterprise-focused users said they DO co-market with partners.

- 33.10% of mid-market companies DO NOT co-market with partners.

- 66.90% of mid-market companies DO co-market with partners.

- 25.15% of Startups DO NOT co-market with partners.

- 74.85% of Startups Do co-market with partners.

- 33.67% of all companies in our database DO NOT currently co-market with partners.

- 66.33% The good news is, that most of our community co-market with partners.

*If you do find value in this growing annual grreport, please contribute to it by creating your Partnerhub® profile today. |